You don't think about international banking—until you have to. For years, I swiped my card abroad and pulled cash from ATMs without a second thought. I figured, 'this is just what travel costs,' and assumed my bank was handling currency conversion the 'right way'—until I learned how the system actually works. Like many things in this world, there is a game of sorts being played here. And once I started digging into how foreign exchange works, I realized that the game was rigged.

Most travelers never think about this. But once you look deeper, you realize that not only have banks designed foreign transactions in a way that gives them lots of opportunities to make money off of us, but all the while they are obscuring the process to keep us in the dark.

The Bougie Tech Dad Forex Maturity Scale

Before diving into the details, let me introduce a framework I've developed after years of international travel and financial optimization—the Bougie Tech Dad Forex Maturity Scale. This four-level system will help you understand where you are now and how to level up your international banking game:

Most travelers are stuck at Level 0 (completely unaware) or have only reached Level 1. By the end of this post, you'll understand how to operate at all four levels and potentially save thousands of dollars in the process.

The Basics: How Banks Profit Off Travelers

What is the business of a bank? It's money: moving it, protecting it…and making it. They are all about making money. And they are very, very good at it.

Let's break down how this works with foreign exchange (forex). Three services that banks offer to international travelers are:

Credit/debit cards for convenient payments

ATM services for pulling cash

Transfers for moving money from one country to another

Super important stuff, for sure, with lots of moving parts. And if you want to avoid the traps of their rigged game, it's worth spending some time to learn how those parts work. Because while the convenience of using one card to pay for everything as you trot around the globe may be awesome, if you take a closer look, you will start to see how the rigged game is always lurking right beneath the surface, with the banks taking a cut every step of the way.

The costs that are baked into every foreign card transaction–whether it's a credit card payment or a cash withdrawal–fall into two categories:

Transaction fees

Exchange rate manipulation

Transaction Fees: The Visible Costs

Most international travelers probably don't worry too much about the fees. After all, we only really see these when we're on vacation, and it's easy to write it off as just a part of the cost of enjoying the trip. I've done that myself, when I've stood at a foreign ATM and thought, 'A seven euro charge to pull cash? The convenience of having that cash in hand is worth the price of a latte.' Like I said, it's easy to rationalize it as the cost of doing business.

And the banks usually throw us a bone on the fees–or at least they want us to think that. It's pretty easy these days to get a credit card with 'no foreign transaction fees'. And most of them also reimburse us for ATM fees. So we go for that offer and think that we've solved the problem: do a little work on choosing the right card and you've already saved yourself some money. Good job! You've reached Level 1 on the BTD Forex Maturity Scale.

Exchange Rate Manipulation: The Hidden Costs

But the fees are just one part of the trap. The second way they get you is via the exchange rate. Here's how exchange rates work:

There is a base exchange rate between two currencies that is used by all banks as a standard reference. It is agreed on, published, and updated constantly throughout the day. You can usually find it online pretty easily [XE.com or similar currency exchange rate sites].

But when you pay with a credit card or pull cash from an ATM, you're not going to get that base rate. The banks have access to that rate because they are moving huge sums of money through the most efficient networks available. Your little purchase to pay for lunch? For that, they are going to give you a slightly worse exchange rate and pocket the difference. The difference between the base rate and the rate they charge you is called a 'spread.'

This spread can vary, and banks have some freedom to adjust the spread (in their favor, obviously). Not without limits, though. They need to keep it reasonable, lest a competitor underbid them and win your business. That said, let's just say that the established banks don't make it super transparent to you–the customer–how big the spread is.

All told, you're already going to be paying a few percentage points extra on the 'spread.' Exchange rate shenanigans are probably a much more profitable hustle for the banks than visible fees. So it would make sense that this is the stuff that they don't show you as clearly.

The Deceptive ATM Experience

OK, so you need to keep your eye on two things: the fees and the exchange rate, right? WRONG! I wish it were that simple. But banks will often add on layers of extra fees or exchange rate markups. These might be called all kinds of things, so be on the lookout for anything that looks sketchy.

Want some examples of what this might look like in the wild? Here are two pictures I took of ATM screens over the past few years–one from Paris and one from London.

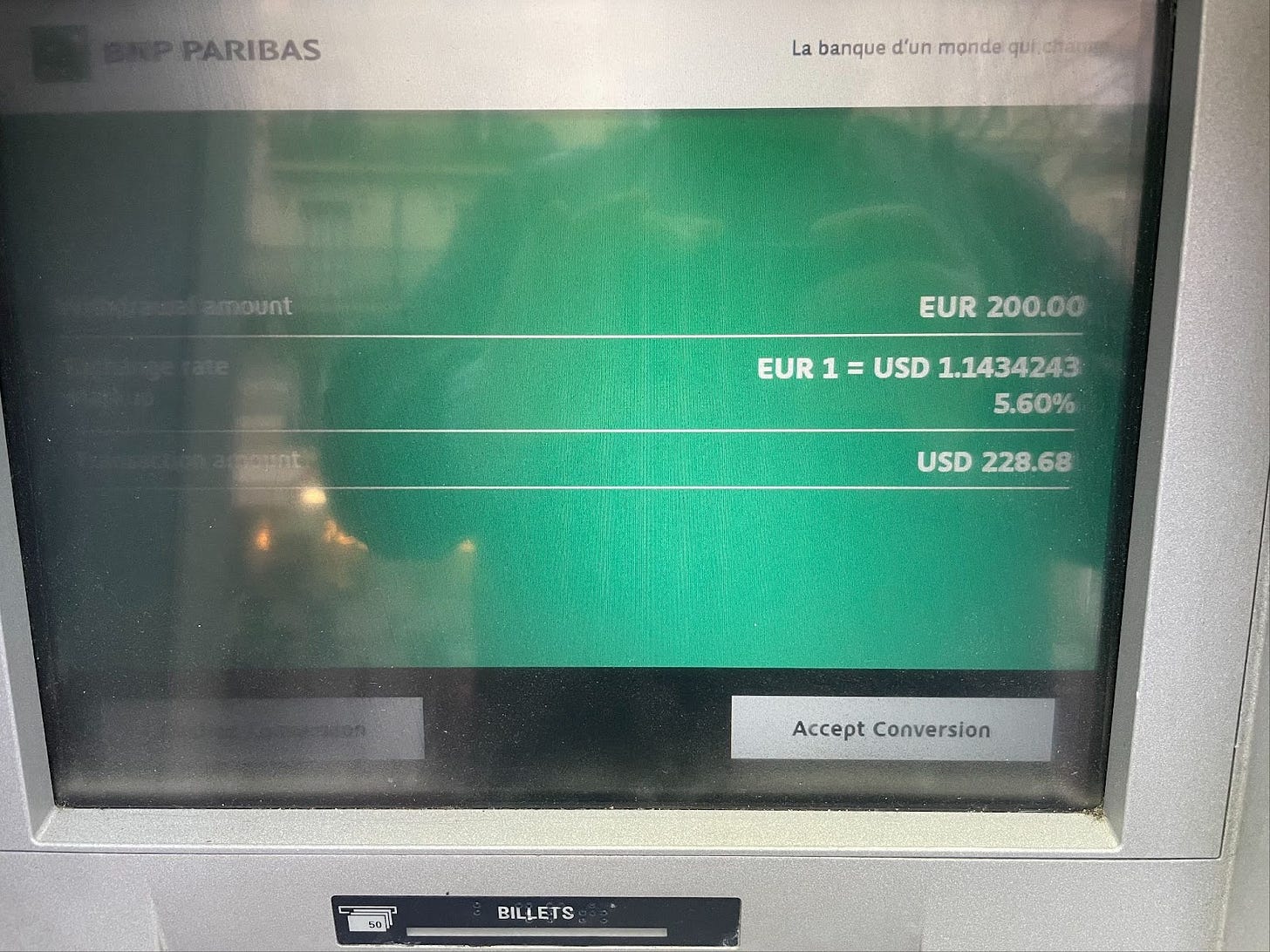

Example #1: An Extra Large Spread, aka 'The BNP Skim'

Apologies for the bad photo. It was a sunny morning, and the ATM had some serious protective covering (with up-charges like this, I might be tempted to punch the screen, too!)

Here's what the screen says:

Withdrawal Amount: EUR 200.00

Exchange Rate: EUR 1 = USD 1.1434243

Markup: 5.60%

Transaction Amount: USD 228.68

[Decline Conversion] [Accept Conversion]

Maybe this looks like an ok deal to you. I mean, paying a 5.6% markup might be worth it. Here's the thing, though: after I canceled this transaction I looked up the base exchange rate. It was 1.0768.

So the bank had already baked a spread of about 1% into their "Exchange Rate" Add in the 'Markup' and they were going to make more than 7% off of my withdrawal.

Also note the two buttons at the bottom: 'Decline/Accept'. This is a clever bit of interface design where you might think that 'Decline' is going to cancel your transaction. And you don't want to do that because you need that cash, right? Also think about your state of mind when you're at this ATM. You're in a foreign city, probably jetlagged, don't speak the language, looking out for pickpockets… Not the calmest you've ever been.

Here’s another thing: When you see a screen like this, your lizard brain is probably running the show, and you want to get the cash. So you're going to have a hard time thinking clearly enough to tap that 'decline' button. But if you tap it, you know what happens? You'll still get your cash. It's just going to be converted at your bank's rate–without the BNP markup. But the good folks at BNP designed this screen to be intentionally misleading in order to pressure you into taking their bad deal.

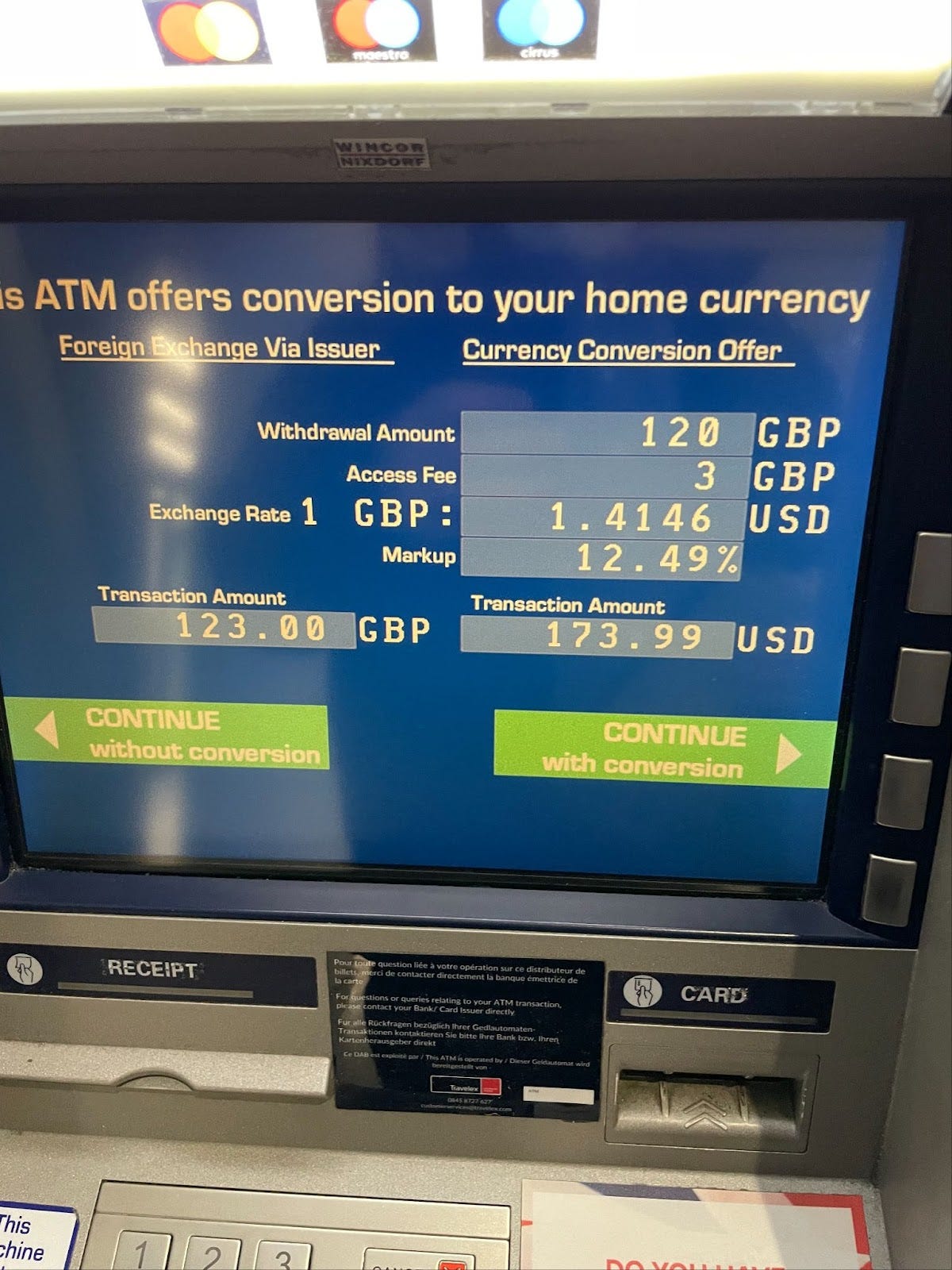

Example #2: Double XL Spread + Access Fee, aka ‘The Heathrow Hustle'

Here's a shot of an ATM I encountered in London's Heathrow airport. This was just after exiting baggage claim and customs.

In this case, the markup is a whopping 12.5%. Plus a nice little 'Access Fee'. All-in, my withdrawal of 120 pounds at this ATM would have stuck me with paying $22.91 in fees and exchange rate markup.

As with the BNP screen, note the design of this screen. It is confusing as hell. Numbers everywhere. The same right/left choices at the bottom. All designed to make it hard for you to make an informed decision, and to force you into taking the bad deal that they're pushing.

A Slight Detour into Banking Culture

Those misleading screen designs on the ATMs? The lack of transparency about what fees they're charging you? The confusion around the moving pieces in the foreign exchange process? These are things that work to the bank's advantage. And they're consistent with the way banking has worked for years. Traditional banks aren't just gouging you on foreign transactions—they're stuck in an outdated mindset that assumes customers have no choice. This is the 3-6-3 banking culture.

The banker of my grandfather's era followed the '3-6-3' rule:

Borrow money at 3% (what a bank pays its customers for their cash deposits)

Lend it out at 6% (what customers pay the bank to borrow cash)

Be on the golf course by 3 pm

This mid-century strategy was the result of a collection of factors:

Governmental regulations that put clear limits on how banks could act–resulting in limited innovation and constrained customer choice

Cultural norms that discouraged customers from asking questions and challenging assumptions. After all, if you can't trust your banker, who can you trust, right?

And in pre-Internet times, access to information about how the system functioned was limited to a select few players who were part of the machine.

Behind that facade of a trustworthy money manager sitting at a big hardwood desk lies a whole raft of practices—ranging from opportunistic, to sketchy, to downright predatory—that are designed to keep customers in the dark and squeeze profit out of them.

The size and influence of the banking industry has been effective at maintaining this illusion of trustworthiness while working hard to keep customers in the dark. Regulations that were designed to maintain economic stability often had the added effect of harming customers by obscuring the way things really worked.

But the 3-6-3 crowd is facing a new world. In case you haven't been paying attention over the past 30 years or so, things have been a-changin' in finance, tech, access to information, and consumer choice. Innovation has come to banking, and some savvy players are changing the way the game is played.

The Turning Point: How Fintech Is Changing the Game

For decades, banks ran the same playbook: charge fees, manipulate exchange rates, and assume customers had no alternatives. But then fintech happened. The rise of fintech wasn't just about adding flashy apps. It was about rethinking banking entirely. Instead of asking 'How do we maximize fees?' these companies started with a different question: What would banking look like if it were built for global customers?

In the 2010's a slew of new players emerged on the scene. It was an evolution driven by a perfect storm of tech advancement, consumer preference, and regulatory easing. At a basic level, people were used to the experience of Netflix, Amazon and Apple. Mobile phones happened. Worldwide broadband became available. And people who were fed up with their banks and the '3-6-3' mindset went looking for better choices. This created an opportunity for ambitious fintech startups to reimagine and reinvent the banking experience.

These new fintech companies offer a killer mix of:

Excellent user experience

Transparency about fees

Understanding of the global citizen

People use different names for this class of companies, but mostly I like to refer to them as Challenger Banks or NeoBanks.

Level 1: No-Fee Credit Cards - The First Step

Are you ready to stop playing by the banks' rules? Most people's first move is to get a credit card with no foreign transaction fees. It's a good start—but it's far from a full solution. With a no-fee card, you'll be saving yourself from any fees that your home bank might charge, but you're still going to pay those three pounds at Heathrow. And you're still getting snaked on the exchange rate.

The other thing to keep in mind is that you should always refuse any kind of 'would you like to pay in your home currency?' offers - be they on an ATM or on the card reader when you're paying for something by credit card. You should always pay in the local currency. Remember: refusing that conversion isn't going to cancel your transaction. It's just going to default back to the basic exchange rate, which is going to be a better deal.

Have you already made the move to a no-fee credit card? Good move! And congratulations. The good news is that you've made it to the first level of the Bougie Tech Dad Forex Maturity Scale. The better news? There are three more levels that will get you even closer to forex mastery.

Levels 2 & 3: Challenger Banks - Local Currency & Multi-Currency Accounts

When you realize that foreign transaction fees aren't the only problem, the next step is cutting U.S. banks out of the equation entirely. Instead of letting your bank dictate conversion rates, you can take control of the process and pay directly in local currency. This is the move that takes you to level 2 of the BTD Forex Maturity Scale.

I started doing this when I opened an account with Revolut. I first heard about Revolut from a Frenchman who lives in London with his American partner and works in finance. So when he talks about how he handles cross-border money operations, I listen. At the time I was looking for ways to go beyond no-fee US credit cards. Cards that would work well across the globe and in different currencies.

At my friend's recommendation, I opened up a Revolut account and started using it to pay for stuff in dollars, euro, loonies, and pounds. Because I'm the curious Bougie Tech Dad, I also explored other NeoBanks. Within a short time, I had opened accounts with Monzo, Wise, and a few others. I put a few hundred dollars into each account, collected all of the garish cards they sent me (NeoBanks seem to favor neon colors for their cards) and then let it all run for awhile to get a sense of how they all worked. Over time, I found Revolut to be the one that worked best for me, but your mileage may vary.

The experience of using these banks definitely feels more like Netflix than a bank. From the very start of the process, you get simplicity of experience, clean app interfaces, easy-to-use functions, products that meet your needs, and recommendations that make sense.

The account opening process typically takes about 10 minutes and can be done while sitting on your couch at home (in the USA is where my couch is). Compare that to the experience of opening up an account at one of the big banks, where you collect some pieces of paper, schlepp to the banking branch, wait in line for your appointment, sit down with a manager, get a sales push for features and products you don't need… The choice is yours, of course, but I think it's obvious where my preference lies.

Level 2: One Card to Pay Them All

With Revolut you get a virtual credit card as soon as your account is created. Put it in your Apple or Google wallet and pay away. (You can also order a physical card if you'd like–it will take a few days to reach you). A virtual card works exactly like a physical one for any online purchases or mobile payments, but isn't something you can physically hold.

Just like that, you have access to simple, cost-effective foreign payments. The basic play is to pay from your USD Revolut account, which will be a good deal—no fees and competitive exchange rates. This alone places you at Level 2 of the BTD Forex Maturity Scale, well ahead of most travelers.

Level 3: Convert Before You Travel

The next step is to convert USD into your destination currency before you travel and then pay for things from that local account with your Revolut card. If you convert USD into Euro before your trip, and then use the Revolut card to pay in Europe, the card will pull from your Euro balance (as opposed to converting on-the-fly from your USD balance).

This means that instead of gambling on a variable exchange rate throughout your trip, you'll have already locked in an exchange rate and can pay from that account throughout your trip. You can also watch the markets and convert when exchange rates are favorable rather than being stuck with whatever rate happens to be in effect when you make a purchase.

Using the Revolut card to make payments is just the beginning. Once you start converting USD into other foreign currencies, the mind-blowing stuff really happens. Because when you create that bucket of Euro in your neobank account (eg: Wise, Revolut, etc) you're not just creating an account balance. In Revolut it's an actual EU bank account, with an account number and IBAN (the equivalent to a US 'routing number').

To a European bank, it looks like a local bank account. Here's how that works: starting with your Revolut USD account, convert some dollars into, say, euro, and Revolut will instantly create a virtual euro account for you. Your new Revolut euro account will behave just like any local euro account, which I have found helpful when paying for things that won't accept US credit cards—like rideshare bikes in Paris, e-scooters in Oxford, or Eurostar tickets between those two countries.

Level 4: Large-Scale Transfers (Wise & Big Forex Moves)

Revolut gives you what it takes to move to levels 2 and 3 of foreign exchange maturity, focusing on how to optimize international payments. But there's another use case out there: I often needed to move sums of dollars to other countries–for things like reimbursing someone for a vacation rental. Or paying school tuition in another country. Or investing in a foreign startup.

Once you get into five- and six-figure transactions, those fees and exchange rates start to add up to some serious money.

If you thought the lack of transparency in credit card fees is bad, just wait until you dig in on what's going on in money transfers. When I started doing the research, I found a very similar landscape:

Fees, both visible and invisible

Predatory exchange rates, often completely hidden by the bank

A banking industry that was actively hiding the whole picture from their customers

Remember those folks who told me, 'My bank doesn't charge me foreign transaction fees'? Only to be shocked when they saw how they were being cheated on the exchange rate? Or vice versa? Here, it was déjà vu all over again.

When I asked a guy who had to wire money regularly to his ex in Europe, he told me, 'My bank (name withheld to protect the guilty) is great. They don't charge me any fees on international wires.' I asked him to look into the exchange rate and get back to me.

And then there was the colleague who was paying for university tuition in Canada, and was thrilled that they could open a US account with a Canadian bank, convert money in that account to Canadian dollars, 'transfer' the money to the kid's Canadian account with the same bank, and have the kid pull out cash via ATM in Canada. Here's a challenge: I'll send a Bougie Tech Dad hoodie to the reader who can name the most points in that process where the bank was screwing the customer.

Making the move to a service that allows you to avoid those fees is what takes you to level 4 of BTD Forex Maturity. When I went looking for a fintech solution to foreign currency transfers, one player was recommended, again and again. Say hello to the next fintech on my NeoBank BFF list: Wise.

Wise has a very simple value proposition: they offer the best exchange rates, with low fees. And everything is as transparent as possible at every step of the way. You can go to their site and see exactly how much you are going to pay and how much the recipient is going to receive.

And an absolute power move is that their site has comparison information about every bank you can imagine, where they break down the competition's costs vs Wise's costs. Not surprisingly, Wise wins almost every time. And in the cases where they don’t beat a local bank (check out converting USD to EUR via ABN in Amsterdam), they’ll admit they can’t do better and wish you a nice day.

How can they make money this way? It's pretty simple, really. They are committed to transparency and smooth execution. All overlain with an outstanding user experience.

Here's how the mechanics work (in this example, you want to send USD from the USA to Euros in France):

You initiate a transfer from your US bank/brokerage account to your Wise USD account

You convert the USD to EUR in the Wise app—with fees and exchange rate clarity

Transfer the EUR to your recipient using IBAN information

They charge a small, transparent fee and give you a competitive mid-market exchange rate

For large transfers, the savings can be significant. On a $10,000 transfer to Euros, a traditional bank might cost you $400-600 in hidden fees and exchange rate markup. Wise might charge $40-50 total. Paying for a year of university in the UK? That’s about $45,000, so you could be looking at several thousand in savings.

Putting It All Together: Your Forex Optimization Strategy

Now that you understand the BTD Forex Maturity Scale, here's how to implement it in your own life:

For Travelers (Levels 1-3):

Start with a no-fee credit card from your home bank - the bare minimum for international travel

Open a Revolut account (or similar challenger bank) - their card will give you better exchange rates for daily expenses

Convert currency before your trip when rates are favorable - protecting yourself from rate fluctuations

Always decline dynamic currency conversion offers - whether on credit cards or ATMs

For Bigger Money Moves (Level 4):

Use Wise for large transfers - international tuition payments, property purchases, or regular payments to people abroad

Compare the total cost - not just the fees, but the actual amount received by your recipient

Plan ahead - watch exchange rates and transfer when favorable

The financial world is undergoing a major transformation. The old banking model thrived on customer ignorance and limited choice. The new fintech model thrives on transparency, better technology, and smoother user experiences.

By understanding how the system works and leveraging these new tools, you can save thousands of dollars over time and experience the freedom of truly borderless banking. That's a revelation worth sharing.

The Ratings

Bougie Factor: 🎩🎩🎩

While the strategies here don't require massive wealth, they do require a certain cosmopolitan mindset. The multi-currency accounts and specialized cards identify you as someone who travels internationally with enough frequency to care about optimization. There's something undeniably bougie about casually mentioning you'll pay from your euro account rather than your dollar one, or bouncing between four currencies on your phone app, or pulling out a neon-colored challenger bank card in a restaurant. Not over-the-top bougie, but definitely a step above the average traveler fumbling with a Capital One card and hoping for the best.

Tech Factor: ⚡⚡⚡⚡

The neobanks represent a significant technological leap over traditional banking. The technology that enables instant currency conversion, virtual accounts in multiple countries, and dramatically lower transfer costs wasn't possible even 10 years ago. These solutions require comfort with mobile banking, digital wallets, and app-based financial management. While not bleeding-edge tech (hence the 4 rather than 5 rating), this approach involves serious digging into exiting systems and using an innovative mindset to leverage modern fintech innovations and fundamentally reimagine how currency exchange can work.

Is It Worth It? 💰💰💰💰💰

Absolutely worth it. The effort-to-reward ratio here is off the charts. A one-time investment of about 30 minutes to set up accounts can save you 5-10% on every international transaction for years to come. For a family spending $5,000 on an international vacation, that's $250-500 saved with minimal ongoing effort. For frequent travelers or those making larger international transfers, the savings can easily reach five figures per year. The learning curve is gentle, the apps are well-designed, and the financial benefit is immediate and substantial.

Hi John - That's a great catch. I've written it in an unclear way, and your clarification is correct.

The point I'm trying to get across is that one should refuse the on-the-spot conversion. I'll go back and make some edits to make the point correctly.

Thanks for pointing this out!

Under your Level 1 section you say "The other thing to keep in mind is that you should always refuse any kind of 'would you like to pay in the local currency?' offers - be they on an ATM or on the card reader when you're paying for something by credit card."

I've always understood that you DO want to pay in local currency vs. accepting their conversion to USD. Do I have it backwards?